So You’re Still Thinking About Buying Ethereum? Here’s What to Know First (Without the Hype)

Key Points

- Ethereum’s Unique Capabilities: Ethereum is more than just a cryptocurrency; it is a platform that supports smart contracts and decentralized applications (dApps). This functionality extends beyond simple transactions, enabling complex automated agreements and applications in various industries, such as finance and energy.

- Growth and Potential of Ethereum: It has shown remarkable growth since its inception, with its value increasing significantly in a short period. Analysts have even predicted that it could surpass Bitcoin in market capitalization. This growth highlights Ethereum’s potential and increasing interest from both individual investors and large enterprises.

- Purchasing Ethereum: Ethereum can be purchased through various methods, including online exchangers and cryptocurrency exchanges. These platforms offer different transaction modes to suit both beginners and experienced users. Additionally, Ethereum can also be mined using specialized equipment, providing another avenue for acquiring the cryptocurrency.

If you’re still here — still thinking about Ethereum — that already says something.

We’ve lived through the highs, the crashes, the hype cycles.

We’ve seen the TikToks, the Elon tweets, the “crypto is dead” headlines. Now it’s 2025, and things feel… different.

We’ve got inflation that won’t sit still. Tariffs tightening everything. AI reshaping entire industries.

And now — quantum computing slowly stepping in, with the potential to break the systems we thought were unbreakable.

So yeah — it’s fair to ask:

“Do I still believe in crypto?”

Maybe you’re not looking for the next moonshot.

Maybe you’re just trying to understand what’s still worth learning — and where this all fits in the bigger picture.

That’s where Ethereum comes in. But before you put your money in, put your attention in.

So What Is Ethereum — and Why Does It Still Matter?

Ethereum isn’t just “another crypto.” It’s a platform. A tool. A space for ideas.

It was launched in 2015 by a Canadian developer, Vitalik Buterin — someone who looked at Bitcoin and asked, “What if it could do more?”

At its core, Ethereum is built on blockchain, just like Bitcoin.

✅But it introduced something game-changing: smart contracts — agreements that self-execute when conditions are met, without a middleman.

That means people can build apps — decentralized ones — that don’t rely on banks, servers, or gatekeepers.

And in a time where trust in institutions is shaky, that means something.

Want to Really Understand What You’re Getting Into?

If you’re serious about not just buying crypto, but understanding the shift it represents — read.

Start with:

-

The Infinite Machine by Camila Russo (story of Ethereum’s birth)

-

The Sovereign Individual by James Dale Davidson (if you want to understand the deep why behind decentralization)

-

Life After Google by George Gilder (to get a feel for where the internet — and crypto — may really be going)

Because let’s be honest — we don’t just need “how to buy” guides anymore.

We need frameworks. We need perspective.

We need to ask: What kind of world are we building, and what role do these tools play in it?

The Real Potential of Ethereum (And Why It Still Matters in 2025)

Ethereum’s not just some crypto you buy and hold. It’s a foundation — a platform that powers a new kind of internet.

One where people, not corporations, are in control.

And while the hype comes and goes, the potential underneath? It’s still massive.

Forget just sending digital money back and forth.

People are using Ethereum to build real-world systems that solve actual problems — in energy, law, finance, and even predictions.

Here’s what I mean:

⚖️ Decentralized Courts & Dispute Resolution

Imagine having a disagreement over a freelance contract, and instead of dealing with expensive legal systems, you settle it online — fast, fairly, transparently.

Platforms like Kleros are doing just that — building decentralized “courts” powered by smart contracts on Ethereum, where jurors are randomly selected and disputes are resolved without bias or bureaucracy.

☀️ Energy Sharing & Solar Trading

There are projects exploring how Ethereum could help people trade excess solar energy with neighbors — without going through giant utility companies.

Instead of centralized control, smart contracts can manage peer-to-peer exchanges securely.

It’s already being piloted in parts of Europe and Australia — and could easily show up in U.S. markets as energy prices rise.

Prediction Markets

Ethereum is even being used to crowdsource forecasts — in everything from elections to sports to finance.

Platforms like Augur and Gnosis let people place bets (or “predictions”) on outcomes, and when something plays out in real life, smart contracts automatically distribute payouts.

It’s like the stock market meets trivia night — and it runs without a central operator.

But What About Ethereum vs. Bitcoin?

Let’s clear this up: Ethereum and Bitcoin are not the same.

Yes, both are built on blockchain. Both are decentralized. But their purposes are different.

-

Bitcoin is digital gold. A store of value. A payment method.

-

Ethereum is a programmable platform. It lets developers build apps, automate agreements (smart contracts), and launch other tokens or systems on top of it.

If Bitcoin is like a calculator, Ethereum is like a smartphone — with endless apps and tools that go far beyond just “money.”

⛏️ And What Fuels Ethereum? It’s Called “Ether”

Ether (ETH) is the native token of the Ethereum network. It’s used to:

-

Pay for transactions and fees;

-

Reward validators (formerly miners;)

-

Run smart contracts and apps on the network.

So when someone builds a Web3 app, or launches an NFT, or swaps tokens — ETH is what makes it all happen under the hood.

And yes, you can still trade ETH like any other cryptocurrency, but that’s just one layer of what it’s meant for.

What We’ve Seen — and What’s Changed

Back in 2017, ETH jumped from $8 to almost $400 in six months.

That growth turned heads. People were shouting “flippening” — the idea that Ethereum could overtake Bitcoin in market cap.

That didn’t happen (yet), but the excitement wasn’t wrong.

Ethereum grew not just in price, but in use cases, adoption, and infrastructure.

Now in 2025, we’re past the phase of quick wins. The market is more skeptical, and rightfully so.

But that means those who stick around are more thoughtful. Builders. Learners.

People who want to understand what’s next — not just chase a trend.

Before You Buy, Ask Better Questions

✅Don’t just ask: “Should I buy Ethereum?”

Ask:

-

“What is Ethereum actually used for?”

-

“Where does this fit in the future of finance, tech, or even law?”

-

“What problems is this solving that other systems can’t?”

Because that’s how you make better decisions — not just about investing, but about how you learn, where you spend your time, and what kind of tech you want to support.

So, How Do You Actually Buy Ethereum in 2025?

Buying ETH today is easier than ever — but choosing how to do it depends on your comfort level, the amount you want to invest, and how hands-on you want to be.

Here are the best and most relevant options right now:

1. Use a Beginner-Friendly Exchange (Best for Simplicity)

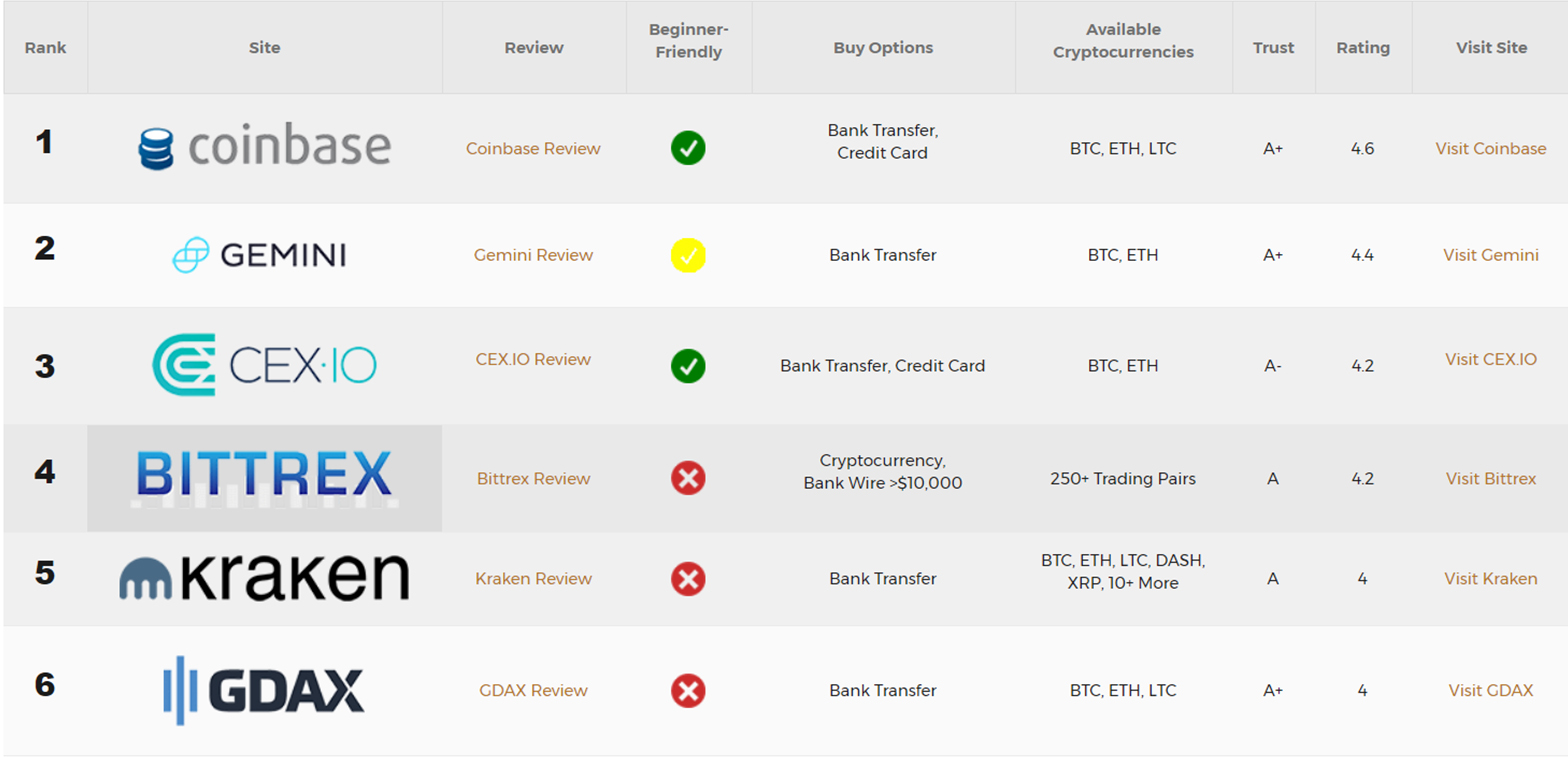

If you’re new to crypto or just want something quick and stress-free, start with a trusted exchange like:

-

Coinbase – Very user-friendly, based in the U.S., and perfect for first-time buyers.

-

Kraken – Also U.S.-based, with better fees and solid security.

-

Gemini – Clean interface and good for recurring purchases.

-

Bitstamp – Longstanding, reputable, and great for both beginners and pros.

These platforms let you:

-

Create an account

-

Link your bank or card

-

Buy Ethereum in just a few clicks

They’ll handle the conversion, store your ETH if you want, and show you real-time prices. If you’re not ready to dive into the deep end of crypto, this is your lane.

2. Use Advanced Crypto Exchanges (For Lower Fees + More Control)

If you’re ready to learn a bit more and save money in the long run, consider using advanced exchanges like:

-

Binance US – Great rates and a ton of trading tools;

-

KuCoin – Not U.S.-based but popular globally for low fees;

-

Crypto.com – Offers both quick buys and a full trading interface.

These platforms often offer two types of buying methods:

-

Instant Buy – Just a few taps, ideal for small amounts (though slightly higher fees.)

-

Market/Limit Orders – For experienced users who want to set their price and maximize efficiency.

If you’re investing larger amounts or trading often, using market orders can help you avoid overpaying.

3. What About Mining Ethereum?

This used to be a huge topic — people buying rigs, setting up mining farms, and cashing in.

But as of Ethereum’s “Merge” update, Ethereum no longer uses proof-of-work (aka mining). The network now runs on proof-of-stake, which means:

-

You can no longer mine ETH the traditional way.

-

You can stake ETH to earn rewards — but this requires technical knowledge or third-party staking platforms.

So if you see articles about “how to mine ETH,” double-check the date. That info is likely outdated.

Bonus: Consider Using a Wallet You Control

If you’re holding Ethereum for the long term, think about moving it off the exchange and into your own wallet.

Top wallet options:

-

MetaMask – Browser extension and mobile app for interacting with Web3 apps.

-

Trust Wallet – Beginner-friendly and good for storing multiple tokens.

-

Ledger or Trezor – Hardware wallets that store your crypto offline for max security.

Storing your ETH yourself means you have full control over your assets — just don’t forget your recovery phrase.

Still Not Sure What to Use?

Here’s a quick cheat sheet:

| Goal | Best Option |

|---|---|

| Easy & fast purchase | Coinbase, Gemini |

| Lower fees | Binance US, Kraken |

| Mobile-first access | Crypto.com, Trust Wallet |

| Long-term storage | Ledger (hardware wallet) |

| Web3 interaction (NFTs, DeFi) | MetaMask, Phantom (for Solana) |

Share What You’re Learning

Crypto isn’t a one-size-fits-all space — especially not now. If you’ve found a tool or method that works well, don’t keep it to yourself.

Share it with others. Post it in forums. Drop a comment on blogs.

This space grows because people help each other stay informed.

And if you’re still figuring things out? That’s normal.

This isn’t about “getting in early.” It’s about getting in with clarity.