Understanding First-Time Loans

Key Points

- Credit Matters: A strong credit score leads to lower interest rates and flexible terms; poor credit increases costs and limits loan options.

- Loan Types: Secured loans require collateral like homes or cars, while unsecured loans rely on creditworthiness without property risks.

- Plan Repayments: Missing payments increases debt through compound interest and late fees, damaging credit and future borrowing ability.

The reason you may need a loan may vary. It may be for your first car or a down payment for a house.

Here are 5 things to know about first-time loans.

Americans between the ages of 35 and 64 carry an average debt portfolio of well over $100,000.

Before you jump out of your seat reading that number, it’s essential to understand that not all debt is bad debt.

Debt could mean the purchase of a home in which you’ll raise your children.

It could mean getting the financial help you need to pay an emergency medical expense or help a loved one finish their education.

There are many reasons why people take out a personal loan.

If you’re considering taking out your first loan product, you may ask yourself, “what is a personal loan?”

While the concept of borrowing money seems simple enough, for applicants of first-time loans best suited for your personal needs, it’s essential you have a deeper understanding of what the loan process entails.

Taking out a loan can get complicated, especially when interest is considered.

Sometimes it’s hard to know whether you’ll even qualify, which is why it’s important to know how to qualify for a personal loan before you apply for one.

To help, our team has put together this list of things you need to know before getting a loan.

What Are Personal First-Time Loans and Why Do People Get Them

Personal first-time loans are products where a bank or lending institution loans borrowers a pre-determined amount of money.

The borrower then uses the money for their expenses and gradually pays the lender in small installments until the loan is paid in full.

There are a variety of reasons why people pursue first-time loan products. Some of those reasons include:

- Home repairs;

- Car repairs;

- Purchasing a vehicle;

- Paying for a vacation;

- Buying necessities between paychecks;

- Paying down costly debt;

- Purchasing furniture;

- Paying tuition expenses;

- Medical costs.

The above list is by no means comprehensive but gives you an idea of the wide variety of applications for a loan.

Some lending institutions will ask what your loan will get used for to help determine the risk of you defaulting on payments.

Others will only verify that you’re over 18 years old, have a checking account and a job.

How Credit Affects Your Loan Product

There’s no one size fits all answer to the question of “What is a personal loan?” That’s because personal loans vary wildly in many different ways.

Loans can be for various amounts, and have different interest rates, terms, and conditions.

Your ability to secure the most favorable personal loan will have a lot to do with your credit score.

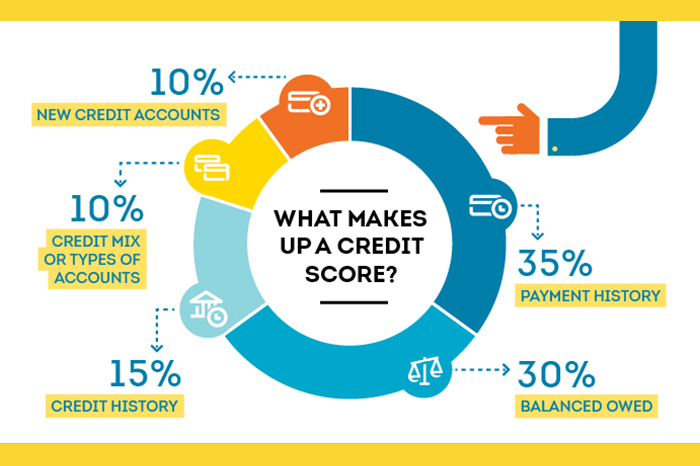

Your credit score is a number that gives lenders an idea of the risk involved in letting you borrow money.

This score gets calculated based on a variety of factors including your past payment history, how many loans you’ve taken out in the past, how long you’ve been actively borrowing money, etc.

If you have bad credit, you can expect to get a loan with high interest, which may require collateral and an inconvenient payment structure.

Alternatively, loans for good credit will have low interest, won’t require that you secure your debt, and will be very flexible with your payments.

To better understand your credit score, consider signing up with a free credit check service or request your credit report from the major credit bureaus for free.

What is a Secured vs. an Unsecured Loan

Personal loans come in two varieties, secured and unsecured loans.

A secured loan means that to get the money you need from a lender, you need to offer up some sort of property that the lender can take from you if you don’t pay them back on time. Some examples of property used to secure loans include:

- Vehicles;

- Homes;

- Stocks/Bonds;

- Boats;

- Wage garnishments.

With unsecured loans, your reputation as a good borrower (as is determined by your credit score) is enough security to borrow money.

That means you don’t need to deal with offering up property to get the first-time loan cash you need.

How Much Loans Cost

When seeking first-time loans, some of the most important differentiators will be the loan product’s cost.

Charges levied by lending institutions for borrowing typically come in the way of interest and fees. Your loan’s interest rate tells you what percentage on top of what you borrowed you’ll need to pay back to the lender.

For example, if you borrowed $100.00 at a 10% interest rate, you’ll need to pay your lender $110.00. This can get sticky if you don’t make payments on time.

That’s because the 10% interest rate will compound on most loans, meaning that instead of owing 10% on $100.00, you’ll owe 10% on $110.00 if you don’t pay back your loan amount in full

Beyond interest, fees that may be tacked onto loan products include late fees, account start-up fees, account closing fees, etc.

Be sure to ask your lender about all fees and interest prior to taking out a loan product.

What Happens If You Don’t Pay Back Your First Time Loan

When you borrow money, you’ll have a schedule in which the lender will expect you to pay them back.

If you don’t keep up with this schedule, a few things can happen.

For starters, your loan sum will grow exponentially due to compound interest.

You’ll also be charged late fees, which will again add to your pool of debt in which compound interest can be charged.

If you default on your loan amount altogether and don’t pay back what you owe, your credit will take a big hit hurting your ability to get loans in the future.

It can also affect your ability to get approved for an apartment or other things in life.

Your debt also runs the possibility of being sold to a collector who may harass you until you pay them back.

Bottom line – If you borrow money via a personal loan, do so with a plan and the intention to pay it back in full.

Wrapping Up What is a Personal First-Time Loan

If you’re asking yourself, “What are personal first-time loans?” before taking one out, you’re already well ahead of the curve. Asking questions and understanding the implications of borrowing money is the most powerful tool you can have in saving yourself from financial ruin.

Remember, loans and debt are a regular part of life.

Taken out responsibly from reputable sources, they can improve the quality of your life and the immediacy in which you get to enjoy things!

Want to read and learn more from the hottest articles on the internet covering topics from lifestyle tips, travel advice, and beyond?

If so, keep satiating your need to know by digging deeper into today’s Internet Vibes pool of content!