A Simple Guide for Beginners on Investment in Real Estate

KEY POINTS

- Real estate grows in value over time, making it a stable investment compared to other options like businesses that might not succeed.

- Mortgages can be more beneficial than renting since they build equity, and there are tax benefits that make owning a home more affordable.

- Starting with real estate investment early, even in small ways like using investment apps, sets a foundation for future financial stability.

Some people hear the word “investing” and automatically think of people with lots of money to burn. Even millennials can get in on the investing game, such as genuine estate.

Here’s an essential guide on investing in real estate, even if you know nothing about real estate investing. It’s hard for many millennials to imagine investing in anything right now.

Student loan debt is overwhelming; many feel they’ll never escape it.

So it’s easy to see why investing in real estate isn’t high on people’s minds. It seems impossible. It’s not, though, and it’s a great idea. Real estate gains value over time, unlike cars or things that depreciate. Buying real estate or investing in it as early as possible only gets better results.

Not satisfied with those vague answers? You should invest in Real Estate, even as a millennial, for plenty of specific reasons. Below are the reasons why you should invest in real estate and how to do so.

Rent Vs. Mortgage

First off, let’s talk about what a mortgage is. You’ve heard your parents talk about theirs, but do you know how it works? A mortgage is a home loan. You put down a certain amount of money (your down payment) and then pay the rest monthly over time.

It’s like your down payment is the security deposit, and the rent you pay every month goes into your pocket years down the line. Some properties offer rent-to-own, which is precisely this principle.

What is the reason people buy houses over renting? When you rent, you don’t earn anything. You’re giving money to your landlord, who does whatever they want with it.

With a mortgage, you build equity. Equity is like a line of home credit. When you pay the bank back the mortgage loan, you will own the house when it’s all said and done.

You save money by getting a mortgage in the long run, though it doesn’t seem like it initially.

There are grants for young people buying houses that can make mortgage payments cheaper than rent in most places. See if there are real estate grants available in your state. Some get lucky and get their funds via a virgin casino promo code, which may help you to try it.

Favorable Tax Benefits

When you own a house, the government doesn’t tax you on your mortgage payments. It’s not that straightforward, so here’s how that works.

You declare to the government how much your house costs you a year, mortgage, property taxes, and interest. Then, you can claim that amount as tax-free, and it’s not considered taxable income.

Whatever profit you make is taxable if you sell your home, but not if you meet certain criteria. We’re not tax accountants, so we won’t get into the details.

Aside from tax benefits, you could learn plenty of strategies from experts, such as adviseretax.com, to save on your taxes.

This also applies to international real estate. So, if you decide to buy a holiday rental abroad, you can still save on your taxes. You’d be surprised by the difference it can make!

Less Risky Than Business

When you invest in a business, there’s risk involved. That business has a high chance of failing (depending on the market), and you don’t get a return on your investment.

If you buy a house or property, it will not fail. Sure, things could happen to it, but there’s insurance for that. You don’t get investor’s insurance for a picky, shaky business plan.

It Gains Value

Unlike that iffy company you invested in, real estate gains value over time. Instead of depreciating the minute it’s used (like a car), it’s worth more the longer you keep it.

To understand this, think of things like inflation and the rise in population. More and more people need a place to live. You’re golden if you can provide a required item in a high-demand, low-supply environment.

It Makes Banks Trust You

If you’re in your early 20s, you may feel like adults don’t take you 100% seriously—especially adults at the bank trying to get a home or car loan.

Don’t depend on your parents for that co-signature. Instead, show up with an investment portfolio. It’ll show the bank you’re serious about building wealth and that you’re responsible. Nothing says no; this isn’t a whim, like preparation.

Where to Invest

Before you run off and buy a house or invest in a mutual fund (more later), let’s talk about location. In real estate, there’s one rule: location, location, location. So, where should you look to invest?

For most millennials, the answer isn’t to look to a high-rent place like Boulder, CO, or NYC Real Estate. The main reasoning behind this is simple – most people simply can’t afford to invest there when they start, but if you can, do it! For tips on high-return properties, view here.

Instead, look for a place where there’s a constant need. College towns are a good example.

College sizes are growing, so more people need housing in a small area. If you can snap up an investment property or invest in a college town, it’s low risk.

You’ll also have an easier time finding tenants if you buy than rent. They might not be the cleanest; imagine if you were financially responsible for the messy roommate you had in college!

Do you have a bunch of friends moving to one area? That’s a good sign of where to invest. Paying attention to trends is essential for building an investment portfolio.

Years ago, no one would tell you Tampa Bay was the new place for young people. Now it is! As a millennial, you have an ear to the ground for that kind of thing, so use it!

How to Invest in Real Estate

Finally, the part you’ve been waiting for. We could not jump in; investing is a complicated animal. What is the first thing to do when you want to invest in real estate?

Check your credit score. If you have bad credit, you will struggle to find someone to lend you money to buy a house, whether you are looking to get funds from your bank or a lender like Turning Point Lending, as they will want to be confident that you will be able to make your scheduled repayments.

That doesn’t mean you can’t invest, but it tells you where your starting point is. Pay off your credit cards or debt and build your wealth in other ways.

You want a credit score above six-fifty, if not in the seven hundred. A low credit score means we have a high debt ratio for most of us. You can check your score for free here.

Non-Buying Investment Options

Now, there are still options if you know you can’t put down a down payment or get a loan. You can do a lot from home without going to any intimidating meetings.

You may want to ask your banker or financial advisor what they think, but it’s ok if you don’t have one.

Do you have a relative or a friend who has property? Run your choices by them. Even if you don’t make the choices they suggest, it’s good contextual knowledge.

Option 1: A Starter Portfolio

There are websites whose sole purpose is to get millennials to invest in real estate. Fundraise Starter Portfolio is one of those sites. They invest for you for just five hundred dollars (that’s low in investment terms). They can’t buy you a house for $250 each, but they’ll put your money into two properties.

Your money goes in with other investors, and you all own the property together. You get payments from quarterly dividend payments, share appreciation, interest, and rent.

You may not see an immediate return on investment, but these things take time. There are low fees associated with Fundraise, like a 0.85% management fee. They have specials sometimes, so get on their email list to keep in touch.

Option 2: Mere Pennies

Your spare change can help you invest. Most of us use Acorn, an app that makes micro-stock investments by rounding up purchases to the next dollar.

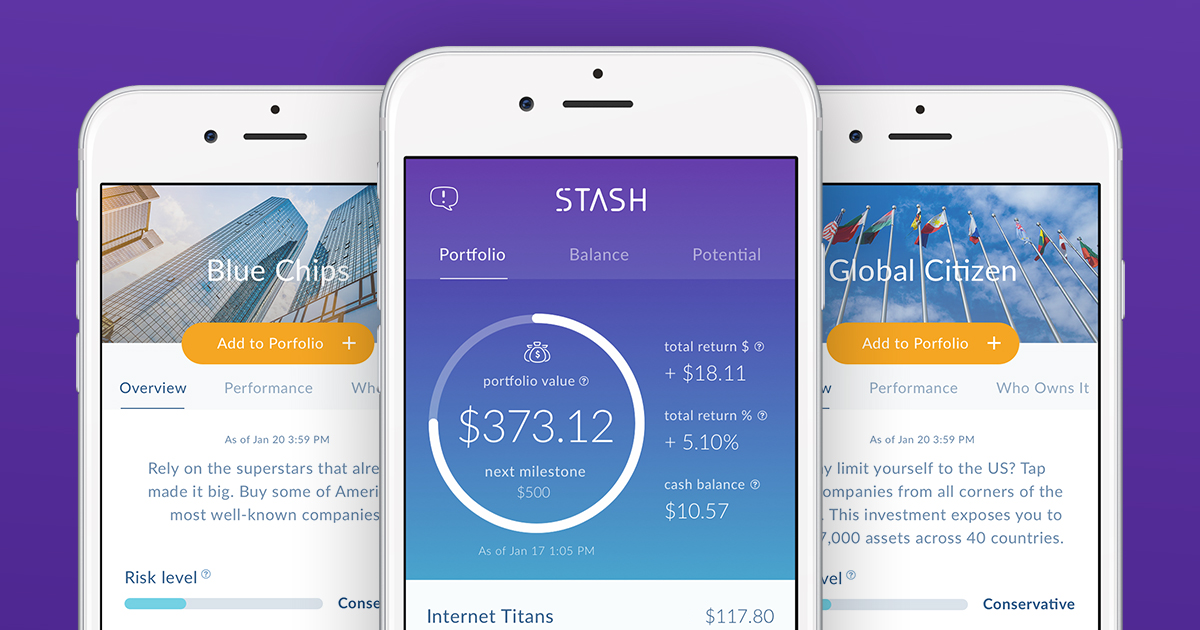

The Stash App is like that but invests in real estate properties. These micro-investments go into real estate investment trusts (REITs). The spare change or small contributions from thousands of investors go into one property, like a living mutual fund.

You won’t buy the property when it is over and done; you share that with other people. But, you can make some passive income by investing your spare change.

Option 3: Empty Land

There are places in large or rural states, like Florida, where people sell land on eBay. Seriously! You can bid on the empty area along with that custom-designed Xbox controller.

It won’t make you much now, but keeping it under your belt will gain worth. One day you may get a call that someone needs to buy that land to build a house, and you sell it at a profit.

You will have to pay property taxes and title transfer fees, but we’re still discussing an under $500 investment, depending on the lot size.

Option 4: Rent to Own

Rent-to-own properties are hard to find. They’re kind of like the investment unicorn. If you find a place you want to live and it offers rent to own, go for it. Make sure you’re not signing your life away.

What happens if you move? Do you lose all that cash investment? Talk it over with a lawyer or at least someone at your bank before you sign anything.

Millennial Investment

In twenty years, landlords will be selling to millennials. We’ll have the opportunity to buy them at higher prices with inflation. Why not buy it now?

If you don’t have five hundred dollars, sign up for an app that does the investing for you. You won’t miss that five dollars a month or so. Plus you can tell your parents you’re preparing for your future, a phone call they’ll be glad to get.

Check out our site for more awesome content about adulting and general life tips. We update content weekly, if not daily!

Please share this post with your friends to impress them with your how-to-invest in real estate knowledge!