Tips For Starting a Financial Advice Business

Launching a new business can be a big deal, but it’s also an incredibly rewarding journey, especially right now.

With the world always changing and introducing new tools and opportunities, there’s no better time to jump in.

Embracing today’s trends is key.

Creative thinking, staying true to your values, and building a solid personal brand aren’t just buzzwords—they’re what customers crave.

And let’s not forget the importance of understanding the unique traits of different generations; it helps tailor your services to meet their specific needs.

So, keep it simple, stay positive, and use these insights to your advantage.

This way, you’ll not only make your financial advice business lucrative but also deeply satisfying.

Starting up in these exciting times? It’s a great call!

Business Planning

As with any new venture, crafting a detailed plan for your business is absolutely essential.

Alongside considerations like naming, startup costs, and overheads, a critical focus should be on understanding your target audience.

Knowing exactly who might be interested in your services and segmenting your market is the cornerstone of effective planning.

It’s a big world out there, and it’s pretty rare for a financial advice business to cater to every corner of the market—those that do are usually massive corporations with resources to match.

So, where do you see yourself making the biggest impact? Maybe you’re drawn to helping small indie startups, or perhaps you thrive in a larger retail environment.

Are you passionate about supporting the arts, or is there another sector that fires you up?

By honing in on a specific segment, you can better tailor your services and connect with potential clients who are looking for exactly what you offer.

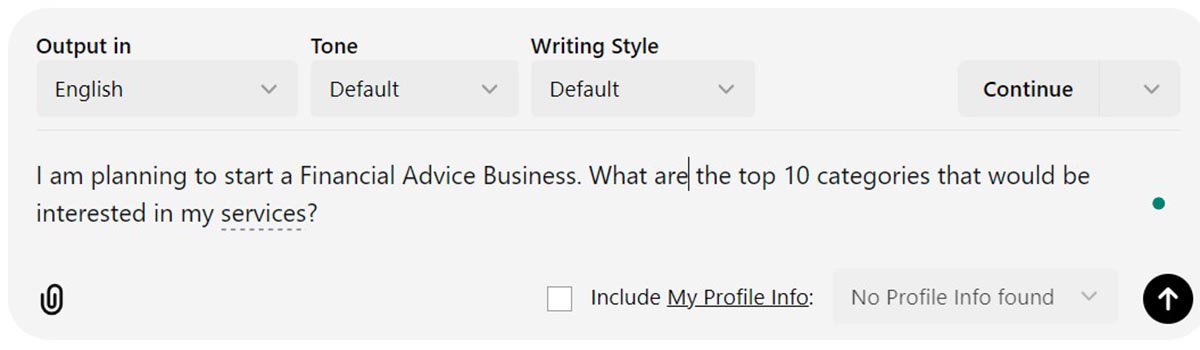

Plus, with the abundance of AI tools available today, it’s incredibly easy to learn about your audience.

Let’s give it a try and see how it can streamline your market research.

So, get excited about carving out your niche—it’s a fantastic opportunity to build a business that not only meets a need but also aligns with your interests and strengths.

Let’s get this planning started and turn your vision into reality!

✅ Chat GPT Prompt

Client Category

|

Description

|

| Young Professionals |

Individuals start their careers looking to build wealth and manage debt. |

| Families |

Managing household budgets, saving for education, and future planning. |

| Retirees |

Managing retirement savings and planning estate distribution. |

| Small Business Owners |

Advice on business financial planning, tax strategies, and growth. |

| Real Estate Investors |

Guidance on portfolio management and financial strategies for property investment. |

| High-net-worth Individuals |

Complex wealth management, tax planning, and investment strategies. |

| Freelancers and Gig Workers |

Financial planning and tax advice for those with irregular income streams. |

| Expatriates |

Assistance with cross-border financial issues and investments. |

| Non-profits and Social Enterprises |

Financial guidance to manage funds, plan budgets, and ensure sustainability. |

| Young Entrepreneurs and Startups |

Financial advice on funding, budgeting, and financial management for growth. |

By getting to know these groups, you can figure out the specific problems they have.

This way, you can customize your services to solve their exact issues, making what you offer really hit the mark.

For example, let’s explore the struggles and pain points that young entrepreneurs and startups may face.

By understanding these challenges, we can begin planning our tailored messages to help them address and resolve these issues effectively.

Know The Struggles and Pain Points of Your Potential Customer

Addressing the top pain points and struggles of young entrepreneurs and startups, particularly in the areas of funding, budgeting, and financial management, here’s how your financial advice can resonate:

- Access to Capital: Young entrepreneurs often struggle with securing the necessary funding to launch or expand their ventures. Your services can guide them through the various options for financing, from venture capital and angel investments to loans and grants, helping them find the right fit for their business model.

- Cash Flow Management: Effective cash flow management is crucial yet challenging for startups. Offer tools and strategies to monitor and manage cash flow meticulously, ensuring they can cover operational costs and avoid common pitfalls that could lead to financial instability.

- Budgeting and Forecasting: Startups need robust budgeting and forecasting to plan their financial future and track their progress. Provide them with personalized budgeting frameworks and forecasting models that align with their business goals and market dynamics.

- Financial Compliance and Tax Planning: Navigating the complexities of tax obligations and financial regulations can be daunting for new business owners. Offer expert advice on compliance, tax-efficient structures, and proactive tax planning to avoid surprises and penalties.

- Scaling and Growth Management: As startups grow, their financial needs become more complex. Help them plan and manage growth with strategic financial planning and analysis that supports scaling efforts without compromising their financial health.

By focusing on these pain points in your marketing and service offerings, you can position yourself as an essential partner to young entrepreneurs and startups, helping them to overcome these common challenges and succeed in their business endeavors.

Establish Your Presence

A good marketing campaign is one of the keys to every successful startup.

Your greatest platform will be the internet, so it’s incredibly important you find and implement good digital marketing for financial advisors, in order to establish your presence and secure your brand.

You will want your company to grow through any means, including word of mouth, but first, you need to draw in your initial customers.

It’s vital that your marketing campaign targets the right audience, and that it presents you as a trustworthy, reliable source of advice.

Put your credentials front and center, and use your personal experience to encourage trust and a sense of authority.

Get Completely Ready

It can be tempting to jump the shark – you’re eager to get started, get stuck in, and start working to grow your business.

However, you mustn’t launch before you are completely ready.

This could be a matter of time, finances, or establishment.

You will need to ensure you can meet demand and make good on any marketing promises before opening yourself up for business.

Otherwise, you risk causing disappointment and damaging your reputation before you’ve barely begun.

Develop a Unique Offering

The financial advice sector is crowded. What distinguishes your service?

Perhaps it’s your commitment to personal branding and values, or maybe it’s the unique vision and creativity you bring to each consultation.

How do you connect with your clients?

Are you employing a human-oriented approach that emphasizes empathy and understanding?

Consider offering perks that resonate with your target audience’s values and needs, enhancing their experience and loyalty to your brand.

Client loyalty is often deep-rooted in the financial sector.

To boost retention even further, provide unparalleled services your clients cannot find elsewhere.

As you draft your business plan, infuse it with innovative ideas and think about practical implementation methods.

By crafting a distinctive business offering that aligns with contemporary trends like personal branding, vision, creativity, and empathy, you’re not just setting up a business—you’re building a brand poised for long-term success.

Seattle-based lifestyle and marketing content creator. I turn chaos into strategy, optimize budgets with paid and organic marketing, and craft engaging UGC.