Are you a First-Time Investor? Then you’ll Need this Actionable Guide

Investing over the long term is the best way to achieve your financial goals. If you want to get started, then this guide will help you to achieve the goals you wish to quickly and efficiently. You may also find a few ways to reduce your risk exposure as well, which is always a good thing if you are new to the market.

Know your Goals

Setting a goal is the best way for you to have something concrete to work with. You need to make sure that you have some long-term aims so you have a reason to ride out any market volatility. You may also want to think about saving up for your retirement or the future of your children.

While the short-term market falls, you need to try and focus on your goals as this will help you to stop selling out and eventually crystallize any losses you may make. If you do not have plans, then now is the time to change that, as it could stop you from making good decisions in the future.

Set up Investments

You do not need to have a large sum of money if you want to start investing. When you think about it, you will soon see that drip-feeding what it is you can afford every month is the way to go. You may also have a lump sum that you can whittle away as time goes on.

Either way, thinking that you can only invest if you have a great deal of money is a huge mistake and it is truly the last thing you want. Your money can buy a lot of shares at a very low price if the market should fall.

You can also buy fewer shares when the market rises. Either way, over time, having good investments set up is the best way for you to handle market volatility. Having a huge sum of money and throwing it at every investment you see is never a good idea, so do not let a lack of funds hold you back.

Keep Your Emotions in Check

If you let your emotions influence your investment decisions, then this will not give you a good return. It is understandable for you to have some jitters if you know that the stock market is falling, especially if you are investing for the first time.

That being said, if you are able to hold your nerve after you have dipped your toes in the water, then this will help you more than you realize. Just take it easy, and see where the road takes you. If you exit too quickly because you are nervous, then this will work against you, and you may even find that you end up being the reason why you are not making as much money as you’d like.

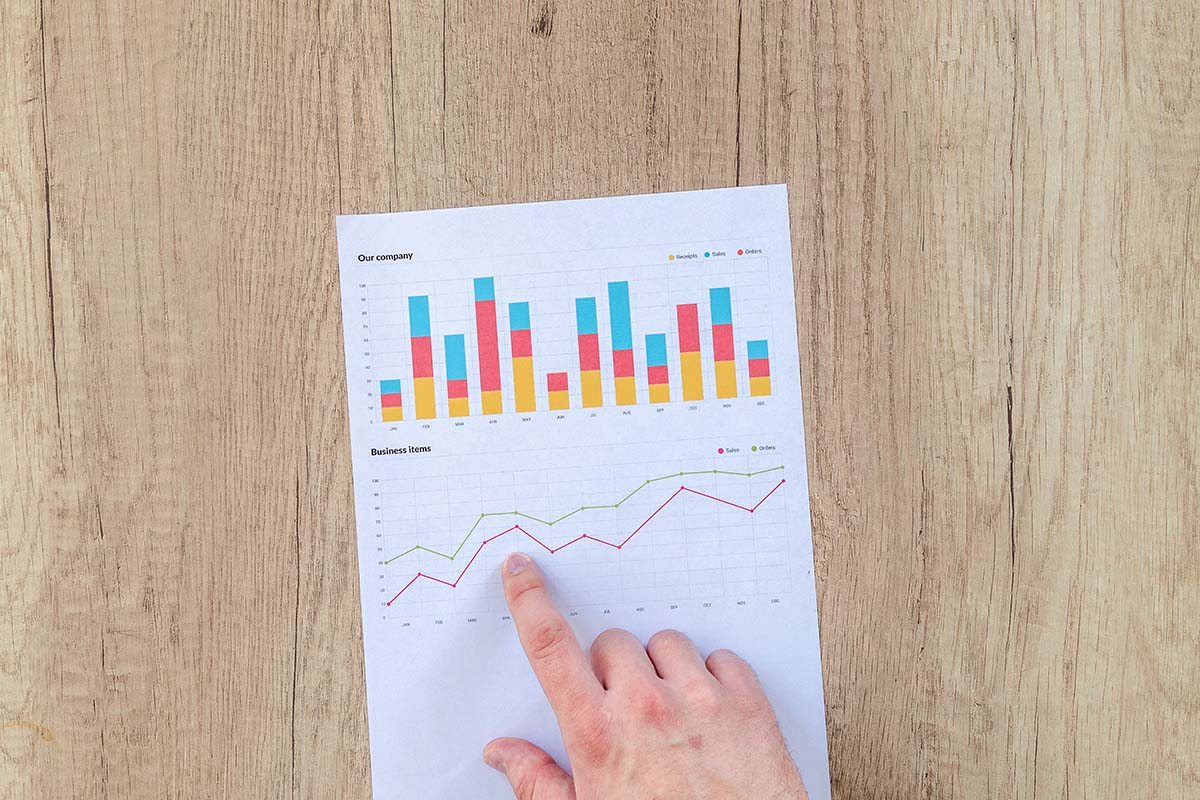

Diversify

If you can, you need to make sure that you are choosing a good spread of investments. Ideally, you need to be looking at bonds, cash, and even equities as well. Different assets tend to behave in different ways, depending on the market condition.

If possible, you need to diversify so that if one goes down you know that you still have a good amount of access to other more profitable stocks. The great thing about doing this is that it helps you to even out your returns and it can also help you to reduce the impact of one asset falling in value. The sooner you can keep this in mind, the sooner you will be able to profit.

Invest Right Now

If you are yet to take the plunge with investments, then what is it you are waiting for? If you are in the position to invest and you are happy to take some degree of risk with your money, then now is a better time than ever for you to get started. If you delay your investment journey, then you may find that you end up missing out on a great deal of positive growth.

This is not ideal if you want to maximize your general profit over time. If you want to make the most out of your investments, then you need to let your fear of missing out take the reins. The earlier you can start here, the sooner you will see your money grow.

So, if you are not looking to invest immediately, try and do something about that. Don’t know where to start? One thing that you can do is look into the best gold investment companies and go from there.

Invest as Much as you want

It is often assumed that investments are just reserved for those who have good jobs and who wears a suit to work. This is not the case at all and if you look at the platforms that are available right now, you will soon see that it is easier than ever for people to get started. You can even have bots invest for you, but ideally, you should give it a go for yourself first.

Think about the Reason Why

If you are just beginning your investment journey, then you may find that there are a lot of options available for you to build the portfolio you want. You have to think about what you want to invest in though. What investment types do you want to try and include in your portfolio? How do you want to minimize your losses? Should you go for corporate bonds?

By thinking about things like this, you will soon find that it is easier than ever for you to try and start taking higher risks. You may also find that investments become less scary as well, so it is imperative that you keep this in mind. If you need some help, then remember that there are a lot of good investment companies out there that can help you to get started and that sometimes this is the only push you need to take the plunge in the market..