Complete Overview Of A Cost-Volume-Profit Analysis

One of the often-used cost accounting techniques is the cost-volume-profit (CVP) analysis, usually referred to as the break-even analysis, which is used to assess the effects of variations in sales volume and costs on a company’s profit.

Finance experts utilize this data to calculate the cost-revenue connection, produce profit, and comprehend performance as a whole. You may develop short-term business plans for your organization by comprehending the notion of CVP.

What Exactly Is Cost-Volume-Profit Analysis (CVP)?

The number of units you must sell of a product to pay your expenses or reach a profit goal is revealed by a cost volume profit (CVP) analysis. This kind of break-even analysis demonstrates to company owners how variations in expenses and sales impact net income.

Let’s say you run a car business. Using CVP analysis, you may determine how many vehicles you’ll need to sell to make a $200,000 profit. But in any case, you should analyze your business so that you do not use the $100 loan instant app no credit check when your business goes down.

Owning a business is complex and risky, but if you find the right strategy, you will no longer think about where to get $100 or $200 for groceries.

By using CVP analysis, manufacturers may choose how many units to make and what selling pricing to use. Businesses perform “what-if” scenarios using CVP analysis, inserting forecasted sales figures into the CVP calculation to see how it impacts the bottom line. Companies use graphs and CVP revenue statements to display CVP analysis.

The following formula is used to calculate the cost, volume, and profit:

Various CVP Analysis Components

The CVP analysis is made up of several distinct elements. These elements include several computations and ratios, further explained in this manual. These are the primary elements of a CVP analysis:

- Variable expense ratio and the CM ratio;

- Inflection point (in units or dollars);

- A level of safety;

- Alterations in net income;

- Operating leverage level.

We must first examine the income statement’s contribution margin structure to execute the CVP analysis correctly.

Methods for Calculating Cost, Volume, and Profit (CVP)

To do a CVP analysis, you’ll need a good grasp of your expenses and a little time.

Fixed Cost Total

You haven’t accounted for every single account in your books. For instance, your utilities have fixed and variable components: Unlike electricity, phone and internet costs are not affected by consumption. As much as possible, divide these costs into fixed and variable categories.

Of course, bifurcating semi-variable costs using statistical regression may be a major deal. However, you may classify all utilities as fixed expenditures if the phrase “statistical” makes you queasy and you’re happy with a quick-and-dirty CVP analysis.

Establish The Item’s Selling Price

CVP analysis helps determine whether your target selling price generates your desired profits. Before you find a selling price that works for your company, you can go back to this phase several times.

Determine The Unit’s Variable Cost

For every extra unit your company produces, variable expenses rise. To determine variable costs, add the following:

- Direct materials (DM): Substances used to make your finished product;

- Direct labor (DL): Pay by the hour for those who produce your finished goods;

- Variable manufacturing overhead (VMOH): Manufacturing supervisors’ hourly pay, shipping, and equipment supply.

Determine The CM Ratio And The Unit CM

The selling price per unit is subtracted from your variable cost per unit. The distinction is the contribution margin, which reveals how much profit is still available to pay fixed expenses.

Divide CM by the selling price per unit to get the CM ratio. The answer, which represents the portion of your selling price covering fixed expenses, should fall between 0 and 1.

Finish the CVP Analysis

Finally, you’re prepared to finish the CVP analysis. Enter your values into the four CVP calculations to see how many units you must sell to get your desired profit.

- Break-Even Sales Volume equals Fixed Costs divided by Contribution Margin Ratio

- Break-Even Sales Volume (units) equals Fixed Costs divided by Unit Contribution Margin

- Target Sales Volume equals (Fixed Costs plus Profit Target ) divided by Contribution Margin Ratio

- Target Sales Volume (units) equals(Fixed Costs a plus Profit Target ) divided by Unit Contribution Margin

Benefits

- The number of sales needed for a company to reach break-even (no profit, no loss) and the level of the sales required to achieve targeted profit are both easily understood using CVP analysis.

- Management may better comprehend expenses at various levels of production and sales volume with the use of CVP analysis. Decision-makers may anticipate cost and profit based on changes in volume using CVP analysis.

- Because it separates the Direct and Indirect costs, CVP Analysis assists firms in comparing the consequences of closing down or operating at a loss during recessionary times.

- The consequences of adjustments to fixed and variable costs aid managers in determining the ideal level of output.

Cost-Volume-Profit Analysis’s Limitations

- A useful tool for illustrating how changes in expenses, selling prices, and volume (in particular) have an impact on an organization’s profit is the cost-volume-profit analysis. However, due to the following underlying presumptions, its use is restricted: If there are many items, they are either offered as a continual mix or as a single product.

- Volume is the sole component that affects revenues and expenditures since all other factors, other than volume, stay constant. This presumption may not be accurate in practice since, for instance, economies of scale may be realized as volumes rise.

- The functions for total cost and total revenue are both linear. It is only likely to sustain a limited, short-term level of activity.

- Costs may be broken down into a fixed component and a variable component. Certain expenses, like phone bills, which may include both a set monthly rental fee and a variable call fee, may be semi-fixed.

- Over the “relevant range,” which refers to activity levels where the organization has the expertise and can conduct some level of reliable analysis, fixed expenses stay constant.

- If absorption costing is utilized, it is assumed that production quantities are equivalent to sales volumes when calculating profits on a variable cost basis.

The Importance Of A Cost-Volume-Profit Analysis

Making a new product or offering a new service may be justified using a cost-volume-profit analysis. You can make better selections by using CVP analysis, which examines fixed and variable costs independently to provide information about how certain profitable goods and services are.

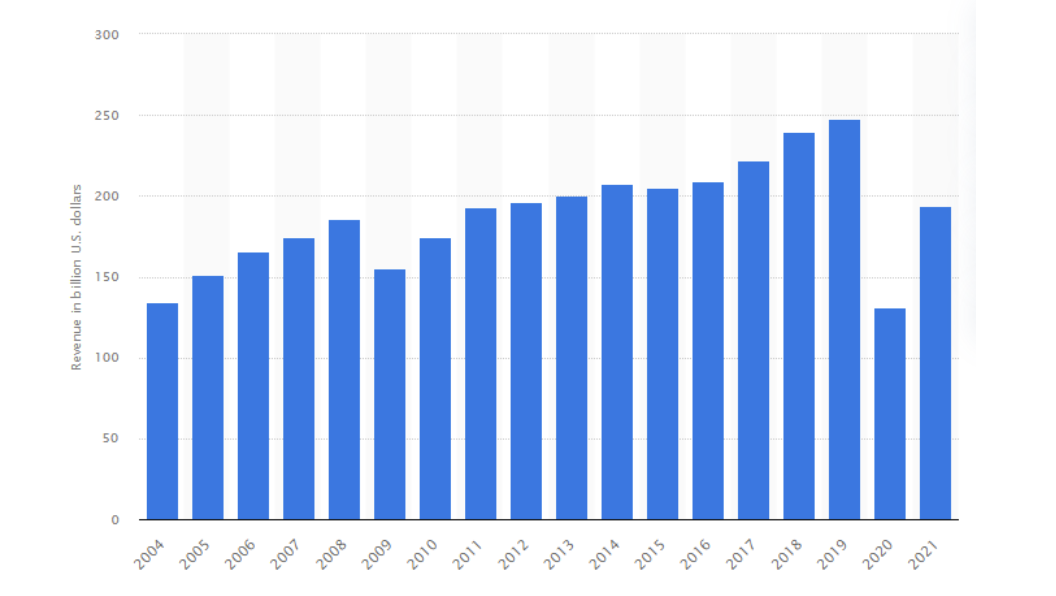

The example shows that Since 2015, the aggregate operating income of American airlines has grown annually, hitting a record-high of 248 billion dollars in 2019. And if you start to analyze this revenue, you will understand that this is not only the cost of tickets but also freight, ancillary income, and so on.

To calculate the number of sales required to break even or achieve a certain profit margin, you might examine many situations. To establish how much a reduction in sales will cost you before you break even, you may also calculate your margin of safety.

Bottom Line

As you have seen, cost volume profit analysis enables you to assess the possible implications on profitability if you were to introduce a new product or service, which may help you enhance the performance of your business. This kind of study depends on several important cost-related key parameters.