A New Trade War? What’s Happening Now

Key Points

-

Trade War Risks: New tariffs on Canada, Mexico, and China could disrupt Seattle’s economy, affecting farmers, manufacturers, and local businesses.

-

Global Impact: Washington’s deep ties to international trade mean these tariffs could increase costs, disrupt supply chains, and threaten jobs.

-

Business Preparation: Local companies must adapt to potential price hikes, shifting trade policies, and evolving economic conditions to stay competitive.

As a resident of Seattle, one of the most breathtaking cities on the Pacific, I can’t help but admire how this blooming metropolis thrives on innovation, diversity, and global connections.

Seattle isn’t just a city; it’s an ecosystem where everything is interconnected—from the economy and trade to businesses and daily life.

And now, our economic landscape is about to face another shift.

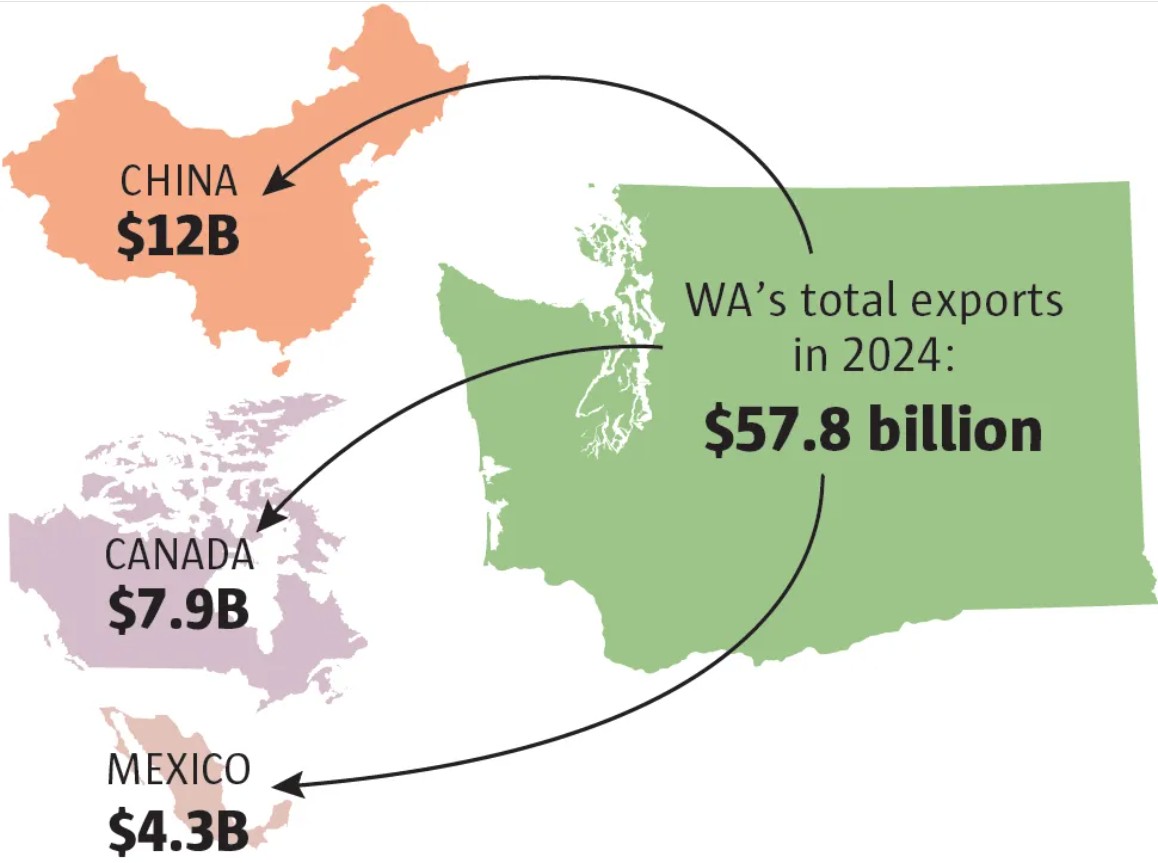

Recently, new tariffs were announced on imports from Canada, Mexico, and China—Washington state’s largest trading partners.

These tariffs, which essentially act as taxes on imported goods, could set off a trade war, impacting businesses, workers, and even the prices we see on our Amazon carts.

While there’s still hope that tensions won’t escalate into a full-scale trade war, experts caution that even a limited dispute could ripple through Washington’s economy.

Our state depends heavily on global trade, with our farmers, manufacturers, and ports deeply intertwined with international markets.

When policies change at the highest levels, the effects are felt across industries—impacting everything from job security and supply chains to the cost of goods and services.

This is the nature of an interconnected economy—when one domino falls, the rest start shaking.

So what does this mean for Seattle and the businesses that call this vibrant city home?

Who will feel the impact the most? And most importantly, how can business owners and workers prepare for the storm ahead? Let’s break it down.

Who Will Feel the Impact?

1. Business Owners & Retailers

Amazon and other e-commerce businesses could face tough decisions.

Tariffs mean higher costs for imported goods, which could force sellers to either raise prices (risking losing customers) or absorb the extra costs (cutting into profits).

This is especially tricky for third-party sellers on Amazon, who make up about 60% of sales on the platform.

Unlike Amazon itself, these small businesses don’t have deep pockets to weather the storm.

✅Example: Imagine you run an online store selling phone cases imported from China. With new tariffs, your supplier raises prices by 20%.

You now have to decide: do you increase your prices, making your product less competitive, or keep them the same and eat the loss? Neither option is ideal.

2. Farmers & Food Exporters

Washington is a major exporter of seafood, dairy, fruits, and vegetables—all of which are now subject to retaliatory tariffs from China.

Farmers who depend on international sales could see their profits shrink as other countries look for cheaper alternatives.

✅Example: If China slaps a 15% tariff on Washington apples, Chinese buyers might turn to other suppliers like New Zealand. That means fewer sales for Washington farmers, leading to possible job losses and price hikes at local markets.

3. Manufacturers & Aerospace (Hello, Boeing)

Manufacturers using steel and aluminum—like Boeing—could see costs rise due to Trump’s separate 25% tariff on those materials. Washington’s aerospace industry depends on global suppliers, and these tariffs could drive up production costs, making it harder to compete internationally.

How This Affects Everyday Consumers

Even if you don’t run a business, you’ll still feel the impact. If import costs rise, prices for everyday products could follow.

Whether it’s your next iPhone, the sneakers you love, or even groceries, higher tariffs mean companies will pass on the costs to customers.

Inflation on the Rise?

If tariffs make imports more expensive, companies might increase prices across the board. That could lead to inflation, where your dollar doesn’t stretch as far as it used to.

✅Example: A new laptop that cost $1,000 last year might cost $1,200 next year because of tariffs on parts coming from China.

Tips for Business Owners: How to Prepare and Act

If you own a business or are thinking about starting one, now’s the time to be strategic. Here are some ways to protect yourself from the effects of tariffs:

1. Diversify Your Suppliers

If you rely on imports from China, Canada, or Mexico, now’s the time to look at alternative suppliers.

Consider sourcing products from other countries or even local manufacturers to reduce your exposure to tariffs.

✅Example: Instead of importing packaging materials from China, explore options in Vietnam, India, or even domestic suppliers.

2. Plan for Higher Costs & Adjust Pricing

Be proactive. If you know your costs are going up, start budgeting for price adjustments now. Test different pricing strategies or offer bundled deals to encourage customers to keep buying.

✅Example: If you sell clothing, consider introducing premium versions with higher margins to offset increased costs.

3. Explore Made-in-USA Options

One potential upside: Businesses that manufacture products in the U.S. may gain a competitive edge. Consumers are often willing to pay more for “Made in the USA” products, so this could be a branding opportunity.

✅Example: If you run a skincare brand, consider shifting production to an American facility and promoting the fact that your products are locally made.

4. Keep an Eye on Policy Changes

Trade wars are unpredictable, and policies can shift fast. Stay updated with reliable news sources and be ready to pivot your strategy if tariffs are adjusted or new exemptions are introduced.

5. Optimize Your Supply Chain

Use technology to track costs and identify where you can cut inefficiencies. If shipping rates rise due to tariffs, finding cheaper logistics providers or optimizing inventory can make a big difference.

✅Example: If you’re importing electronics, work with shipping providers that offer bulk discounts to reduce per-unit costs.

Is There Any Upside to These Tariffs?

Not everything about tariffs is bad news. Some American companies may benefit if tariffs make foreign competitors less competitive. For example:

- U.S.-based manufacturers may see increased demand as companies look for domestic suppliers.

- Sellers who already source locally may gain a price advantage over those importing from tariff-affected countries.

- Amazon vs. Temu & Shein: Chinese e-commerce giants Temu and Shein rely on cheap imports. Higher tariffs could make their prices less competitive, which might benefit U.S. businesses.

Final Thoughts: What New Tariffs Mean for Washington State

Tariffs are a big deal, and they’ll likely shake up Washington’s economy—affecting businesses, prices, and jobs.

Whether you’re a business owner, an entrepreneur, or just someone who shops on Amazon, staying informed and prepared is key.

If you run a business, now’s the time to adapt.

Diversify your suppliers, optimize costs, and stay flexible. Trade wars are unpredictable, but smart strategies can help you navigate these economic waves.

And for Gen Z entrepreneurs. Stay agile, be innovative, and keep an eye on new opportunities—because where there’s disruption, there’s always a chance to build something better.