8 Strategies for Repaying Debt When You’re Down-and-Out

Do you find yourself in need of money? Don`t know how to deal with this challenging situation quickly? In this case, you can use fit my money – one of the instant cash advance apps to borrow money, but do not forget that this option will bring you high interest in its return.

Apps Are the Best Online Creditors

Cash advance apps are good alternatives to online creditors when you want to get money straight away. It’s Okay sometimes to face financial problems. But, you have to understand that if you have already found yourself in this “room of keys,” which can help you to fix the problem, it is essential to look for one of the most appropriate “keys.” It means you must choose the easiest and most comfortable way for you.

Many people put themselves under stress and anxiety while waiting to receive money from the local bank. Some don’t know what banks require to give you money. Finally, do you fancy wasting your precious time? Indeed, don`t. Paycheck Advance Apps will be the best way for you to get money!

How Does It Work?

A few days before your paycheck, this app can give you a chance to borrow $100. The money will come right out of your paycheck when the app receives it within a couple of days.

Are you interested in ways how to get out of debt? Have no ideas how to pay that debt and live your peaceful life? Lots of Americans dream about a useful plan of strategies with main steps to get rid of their debts.

Getting out of debt is always a complicated and problematic process. The first step that you need to do is to make up your mind you’re done with debt. Just imagine that feeling of calm, no more stress, credit cards, and everything in your life is good!

Believe in yourself! You can change your life for the better!

Here are 8 strategies that will help you to end debt:

Create a Budget

It is not a surprise that many people can’t understand what amount of money they can afford to put toward debt each month. The intelligent method to figure it out is to create a budget. You will agree that trying to manage expenses in your head is challenging, at times, impossible.

However, you will see your money spent if you write the numbers in a notebook. As a result, this life hack will help you to grasp the picture without relying on your memory or other things. Additionally, your budget can give a hand in deciding where you might be able to free up cash to pay off your debt.

Economical Life & Intelligent Shopping

Make some small but necessary changes in your life. Here is a list to think of:

- Biking Is Free Of Charge

Biking is a form of environmentally friendly transportation and a big plus.

- Meals

We don’t have to spend tremendous amounts of money on meals.

- Make a grocery list and stick to it.

- Bring a snack with you to work.

- Skip the brand names and buy ordinary.

- Make drinks at home instead of going to the bar.

- More Than Borrowing Books

Besides borrowing books library allows you:

- Free AC,

- Watch movies for free,

- Many exciting activities (depending on the type of library):

- Speaking clubs;

- Meetings with authors of books and poets;

- Entertaining.

Frankly speaking, all of us (parents) are faced with a “peaceful” request from our children: “I want to go to the amusement park!!!” However, such parks can be too expensive. A good way to save money – try to make your amusement park and entertain your baby. Hence, you and your kid will receive unforgettable emotions.

- Bad & Expensive habit

It’s necessary to consider issues about adjusting your habits, such as smoking. If you say No to a pair of cigarettes every day, you can save money, which’ll help you avoid credits or loans one day!

Plan

All start with a unique plan; loan repayments are not an exception. First, list your debts and the balance and interest rate.

- Determine the priorities of your accounts.

- Choose the order in which you want to repay them.

For example, debt with the highest interest rate first, the lowest balance, or something else.

Stop

Stop putting yourself in debt! You will never recover from debt if you continuously add to your balances.

New debt = New problem

Remove credit cards from your eyes because this will hurt your credit score. A new debt increases your payments, putting additional pressure on your monthly income.

Second Income

The second job has 2 big pluses:

- No need to rely on credit cards to make ends meet.

- There will be more money to pay down your debt.

Nowadays, there are many options by which you can increase your income: freelance work, selling things, making money from a hobby, etc.

Pay on Time

Overdue payments slow down the repayment of your debts. You will need to double your payments next month, as well as pay late fees, which could have reduced your balance. Moreover, 2 subsequent overdue credit card payments will trigger the penalty rate, which will also make it harder to pay off your debt.

Ask for Lower Interest Rate

A high-interest rate = harder to pay off your debt. Lowering your interest rate reduces the monthly interest you pay and repays your debt more quickly. Having a good credit rating and a favorable payment history gives you more power to obtain a lower interest rate.

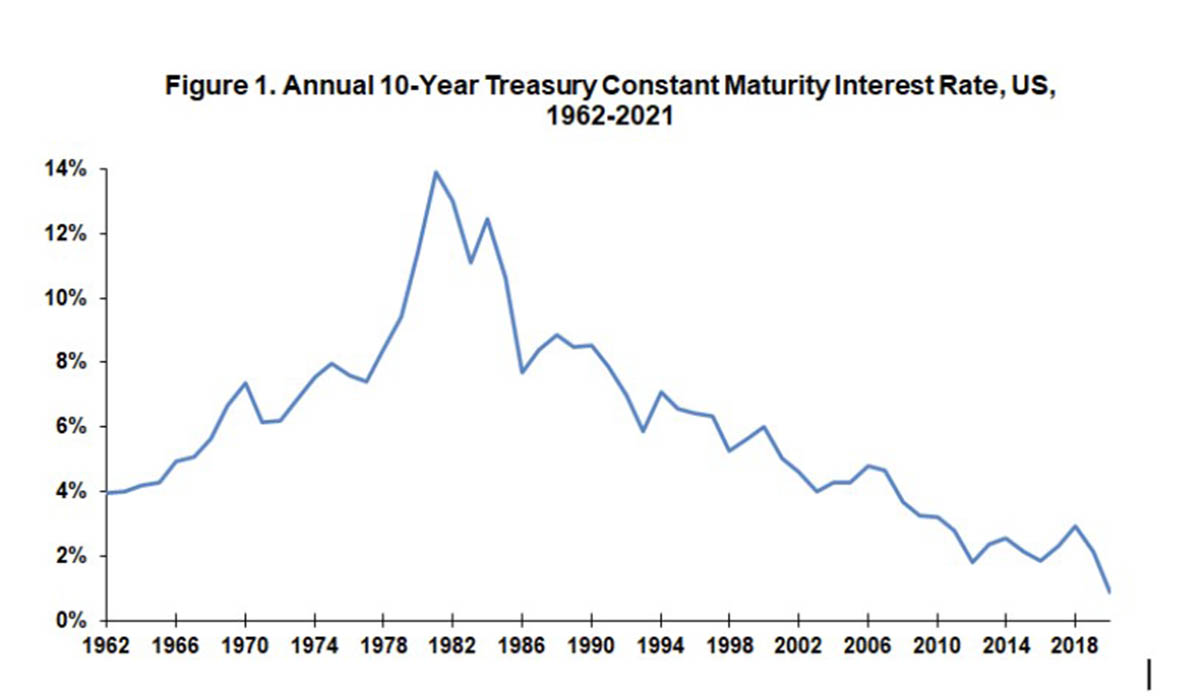

US Interest Rate

According to a statistic below, the 10-year Treasury rate is one of the most closely monitored interest rates determined by the marketplace. Link: https://farmdocdaily.illinois.edu/2021/12/us-interest-rates.html

After increasing throughout the 1960s and 1970s, it decreased steadily from 13.9% in 1981 to a low of 0.9% in 2020. It has averaged 1.4% to date in 2021, with a rate of 1.43% on December 20, 2021.

But, if your credit card issuer does not change their mind, think about transferring your balance to a credit card with a lower interest rate.

Take It One Step at a Time

If you look at your total debt picture, you can be afraid of such a sum, but don’t forget that you won’t cover everything simultaneously. Life hacks to pass your rough time with pleasure:

- Track your progress,

- Celebrate both your little & big successes,

- Keep going until your debt is fully paid down.

Summing Up

So, if you have a debt, choose the most suitable strategy and try to repay it as soon as possible. And remember that it is much easier to avoid debt than to repay it.